As a homeowner with a mortgage, the holy grail is having a mortgage rate below the 10-year bond yield. When you have this situation, it’s like living for free and you should not pay down extra principal. If you had the money, you could invest an amount equal to your mortgage into a 10-year Treasury bond. The interest income can then be used to pay your entire mortgage interest.

The second best situation is having a negative real mortgage rate thanks to inflation and low rates. In such a scenario, although you can’t technically live for free, from an inflation-adjusted standpoint, you kind of are. You shouldn’t be in a rush to pay down debt.

To see if you have a negative real mortgage rate, take your mortgage rate and subtract it by the latest inflation rate. If the percentage is less than zero percent, then you have a negative real mortgage rate. If you have a negative real mortgage rate, you should also slowdown or stop paying extra principal because you’re borrowing free money.

Example Of A Negative Real Mortgage Rate

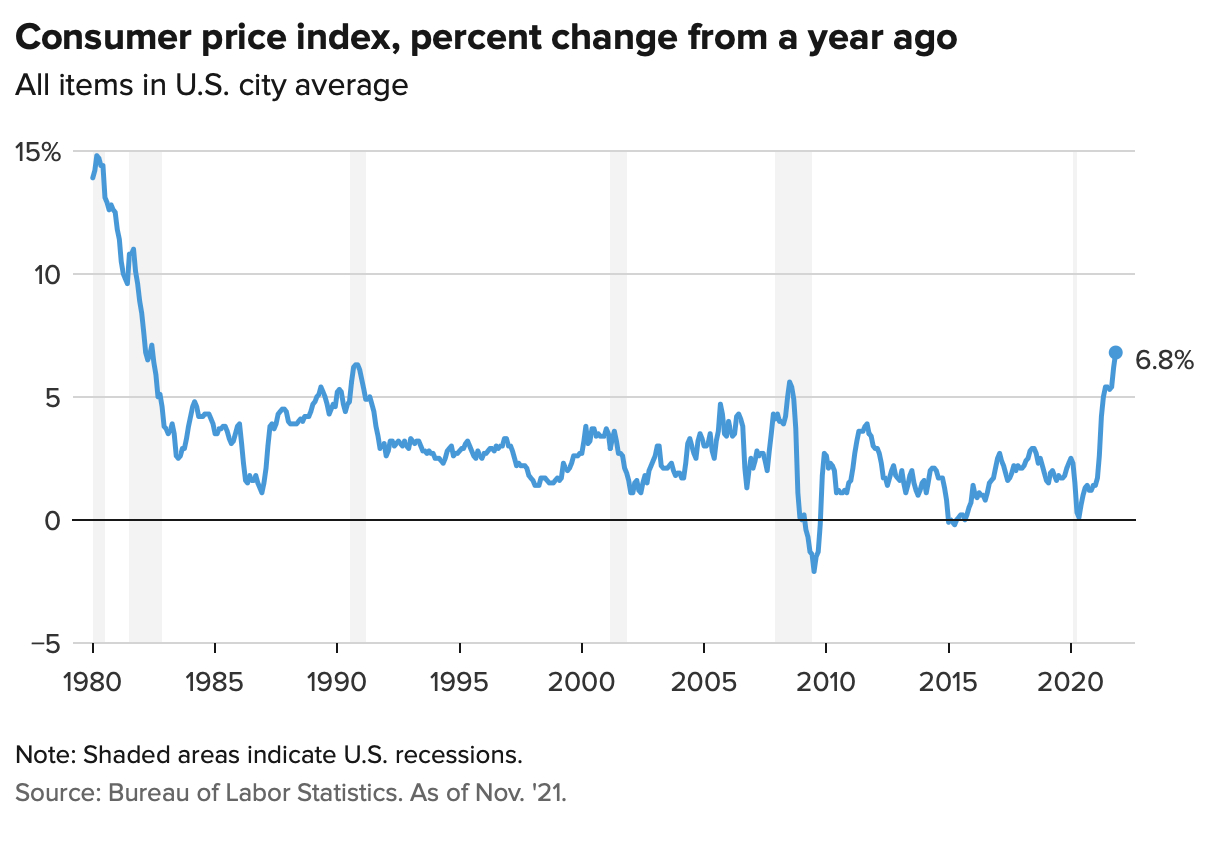

The November Consumer Price Index came in at 6.8%, which is the highest jump since the early 1990s. Meanwhile, the March 2022 CPI came in at 7.9%! With energy prices and commodity prices skyrocketing since the start of the war in Ukraine, inflation will likely stayed elevated for a while.

If you have a mortgage rate that is less than 7.9%, at the moment, you have a negative real mortgage rate. Enjoy it. Hold onto your negative real mortgage rate for as long as possible since inflation is paying down your debt for you.

Let’s use my primary residence mortgage rate of 2.125% for a 7/1 ARM I took out in 2020 as an example. My real mortgage rate equals 2.125% minus 7.9% = -5.775.

A negative real mortgage rate of 5.775% means that in inflation-adjusted terms, it’s like I’m getting paid to borrow at a rate of 5.775%. Free money! Or it might be viewed as a 5.775% decline in the real cost of my mortgage.

Therefore, I should try to hold onto as much of my primary residence mortgage as possible, especially while home prices are rising. Paying down extra principal in this situation is a suboptimal move.

Conversely, if inflation (CPI) came in at 1% instead of 7.9%, then my real mortgage rate is equal to 2.125% – 1% = 1.125%. But even paying a real mortgage rate of 1.125% is cheap. It’s just that getting paid to borrow at a real mortgage rate of -5.775% is just fabulous!

In most economic environments, real mortgage rates are positive, not negative.

Inflation Is A Boon For Homeowners And Debtors

The higher the inflation, the more the real cost of your debt gets inflated away. Further, the higher the inflation, the more the price of your assets tend to go up. Therefore, for homeowners with a mortgage, inflation tends to act as a double win.

This double win is why I’ve been investing in rental properties and single-family homes. I don’t want to be run over by higher rents. Instead, I want to benefit from higher rents to take care of my family.

What’s interesting in our current scenario of high inflation is the 10-year bond yield staying level at around 1.5%, +/- 0.1%. This signals the bond market thinks elevated inflation will be temporary. I agree with this view because the bond market tends to always be right.

I expect inflation to normalize closer to 4% by the end of 2022 and to 3% by the end of 2023. In such a scenario, most homeowners with mortgages will still have negative real mortgage rates because everybody can wisely refinance right now at 3% or less.

A 3% – 4% inflationary environment might be the goldilocks scenario for real estate investors. On the one hand, inflation is high enough to act as a nice tailwind for rent and asset price growth. On the other hand, inflation is not high enough to spook the bond market and cause the Federal Reserve to hike rates too aggressively.

Banks Are Still Winning, Don’t Worry

Let’s say you can get a ho-hum 0.5% savings rate on $100,000 in cash. But with inflation at 6.8%, your real savings rate is -6.4%. In other words, your $100,000 in cash can now only buy about $93,600 of goods this year compared to last year, when it could buy $100,000 worth of goods.

Put it differently, banks LOVE gathering massive savings deposits in a high inflationary environment when they concurrently don’t have to pay a high interest rate. Banks are getting to borrow free money from us to then lend out for a profit. To provide consistent logic, inflation-adjusted, we’re actually paying the banks to hold our money.

Therefore, don’t feel so bad if your lender is earning a real negative return off your mortgage. Your lender is also benefiting from a massive wave of deposits. Lenders can then turn around and lend out your money in a risk-appropriate for a profit.

This chart below is a beautiful site for banking executives. It is one of the reasons why the Financials sector has done well since 2020. Consumers are cashed up and ready to rumble.

Negative real returns on a potentially devaluing currency is one argument for why money has found its way into cryptocurrencies like Bitcoin. Given the supply of Bitcoin is fixed and the supply of the U.S. dollar is not, Bitcoin is seen as an attractive alternative.

One can also make the argument for gold, which has increased by a more subdued 20% since early 2020.

Still Makes Sense To Pay Down Debt And Invest

Although paying down a negative real mortgage is a suboptimal financial move, I still think it’s wise to pay off some debt with excess cash flow. For one, if you do not invest your cash, then your cash is getting negatively affected by inflation. So paying down extra mortgage principal is the lesser “evil” of the two choices.

Second, the money you invest could always lose value. Paying down debt locks in a return equal to the nominal interest rate of the debt. Even if the nominal interest rate is only 2.125%, it is better than losing money on a risk asset that declines by greater than 2.125%.

Finally, concurrently paying down debt and investing creates a perpetual hedge. You’re always winning somewhere, no matter the environment. And when you feel like you’re always winning, you tend to be happier and make even more optimal financial moves.

No one economic scenario will last forever. As a result, you should always adapt your debt pay-down and investing strategy. Luckily for you, there is the FS DAIR framework to follow where it adjusts with the times.

Embrace Your Debt In A Negative Interest Rate Environment

Taking on debt to live a better life today is my favorite reason for taking out a mortgage. If the house then appreciates in value while the real mortgage interest rates goes negative, then you’re living the ideal scenario. The same goes for taking out debt to buy and enjoy any appreciating asset.

Everybody loves getting something for free.

If you’re a renter, you can still win by investing your cash. Stocks tend to do well in an inflationary environment. You could also buy real estate ETFs, public REITs, private eREITs, and individual private real estate investments. Then, of course, there are plenty of other alternative assets that do well in an inflationary environment.

The person who is losing in a negative interest rate environment is someone who holds all cash and never asks for or gets a raise. On the flip side, the person who takes on too much leverage will also lose big if a downturn ever comes and he cannot hold on. Therefore, proper risk control is necessary.

In our current elevated inflationary environment, I suggest slowing down your debt paydown schedule. Wait until inflation gets back down to about 3% before increasing your debt paydown again.

Yes, having a lot of cash in an inflationary environment is not great. However, having cash also gives you the liquid courage to take advantage of new investment opportunities. Get an investment right and it will more than make up for any losses due to inflation.

Recommendations

Check the latest rates: To refinance your mortgage, check out Credible. You can get free real quotes in minutes by multiple lenders. When banks compete, you win. Mortgage rates could be going up with Fed rate hikes.

Investing in real estate: With negative real mortgage rates, real estate should continue to do well. Take a look at some of the single family homes, multifamily homes, etc. that would make great rental property investments in today’s market. You can reach out to our team at Rise Up Real Estate Group for help setting up your search, obtaining pre approval for a loan to fund your investment, negotiating a great deal, closing your investment transaction, etc. In addition, if owning rental property investments isn’t your thing, our team offers private lending opportunities to an exclusive group of investors. What does that mean? That means as we find great deals, this exclusive group of investors are offered the opportunity to lend their money to provide financing for these transactions. And the best part is we love to help our private lenders earn a safe, double digit return on their investment. And even if you’re not investing in rental properties, simply owning a personal home can be a huge advantage. In a negative real mortgage rate environment, real estate is a big beneficiary. Reach out to our team at Rise Up Real Estate Group if any of this sounds interesting to you. We’re here to help when you’re ready to make a move. Rise Up!

Original article found at https://www.financialsamurai.com/negative-real-mortgage-rates/