Over the past few weeks, the average 30-year fixed mortgage rate from Freddie Mac fell by half a percent. The drop happened over concerns about a potential recession. And since mortgage rates have risen dramatically this year, homebuyers across the country should see this decline as welcome news. Freddie Mac reports that the average 30-year […]

Category Archives: Uncategorized

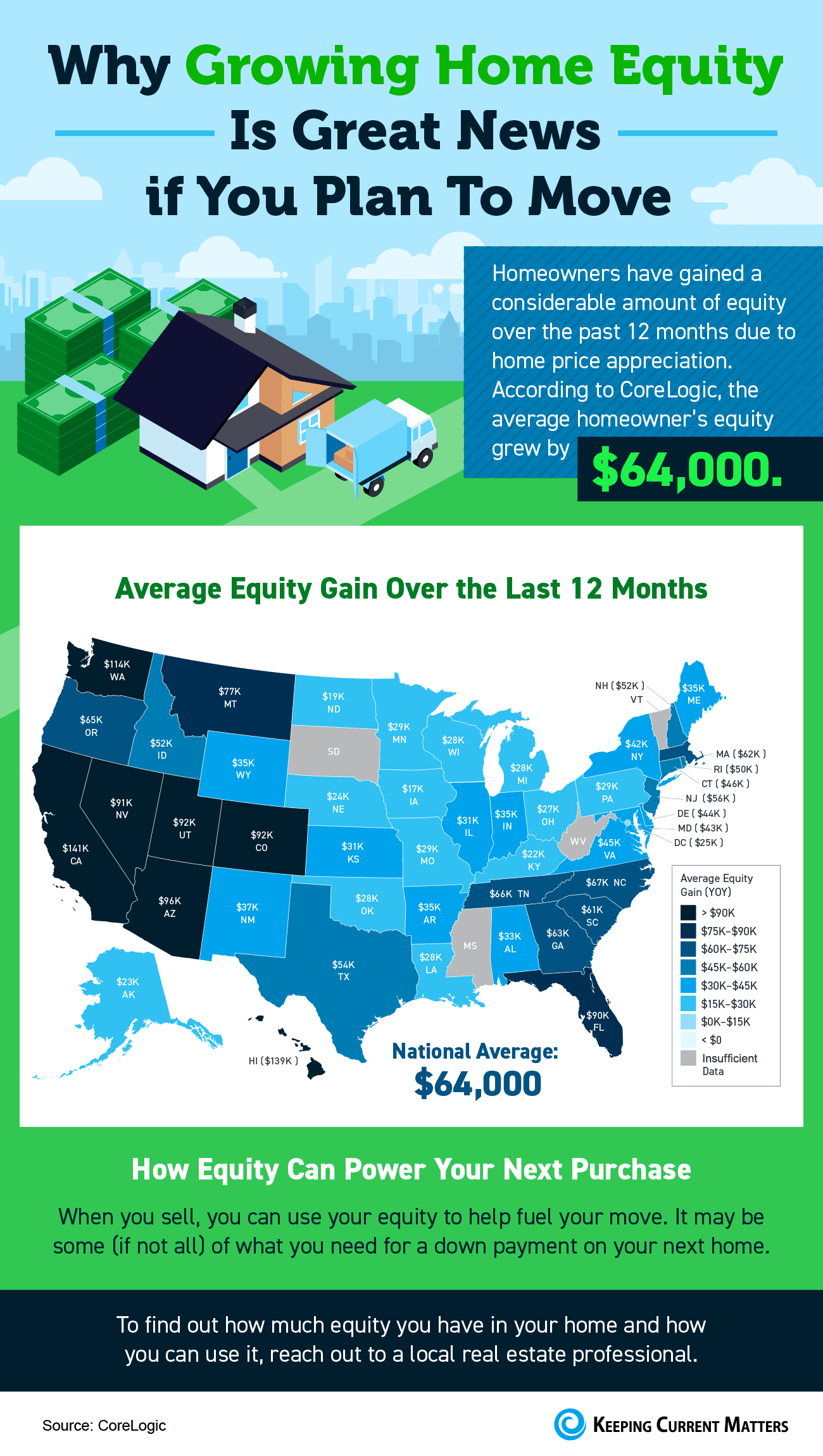

Why Growing Home Equity Is Great News if You Plan To Move [INFOGRAPHIC]

Some Highlights According to the latest data from CoreLogic, the average homeowner gained $64,000 in home equity over the past 12 months. That much equity can be a game-changer when you move. When you sell, it could be some (if not all) of what you need for a down payment on your next home. To […]

What Does an Economic Slowdown Mean for the Housing Market?

According to a recent survey, more and more Americans are concerned about a possible recession. Those concerns were validated when the Federal Reserve met and confirmed they were strongly committed to bringing down inflation. And, in order to do so, they’d use their tools and influence to slow down the economy. All of this brings […]

How Your Equity Can Grow over Time

It’s true that record levels of home price appreciation have spurred significant equity gains for homeowners over the past few years. As Diana Olick, Real Estate Correspondent at CNBC, says: “The stunning jump in home values over the course of the Covid-19 pandemic has given U.S. homeowners record amounts of housing wealth.” That’s great for your […]

Is Homeownership Still the American Dream?

Defining the American dream is personal, and no one individual will have the same definition as another. But the feelings it brings about – success, freedom, and a sense of prosperity – are universal. That’s why, for many people, homeownership remains a key part of the American dream. Your home is your stake in the […]

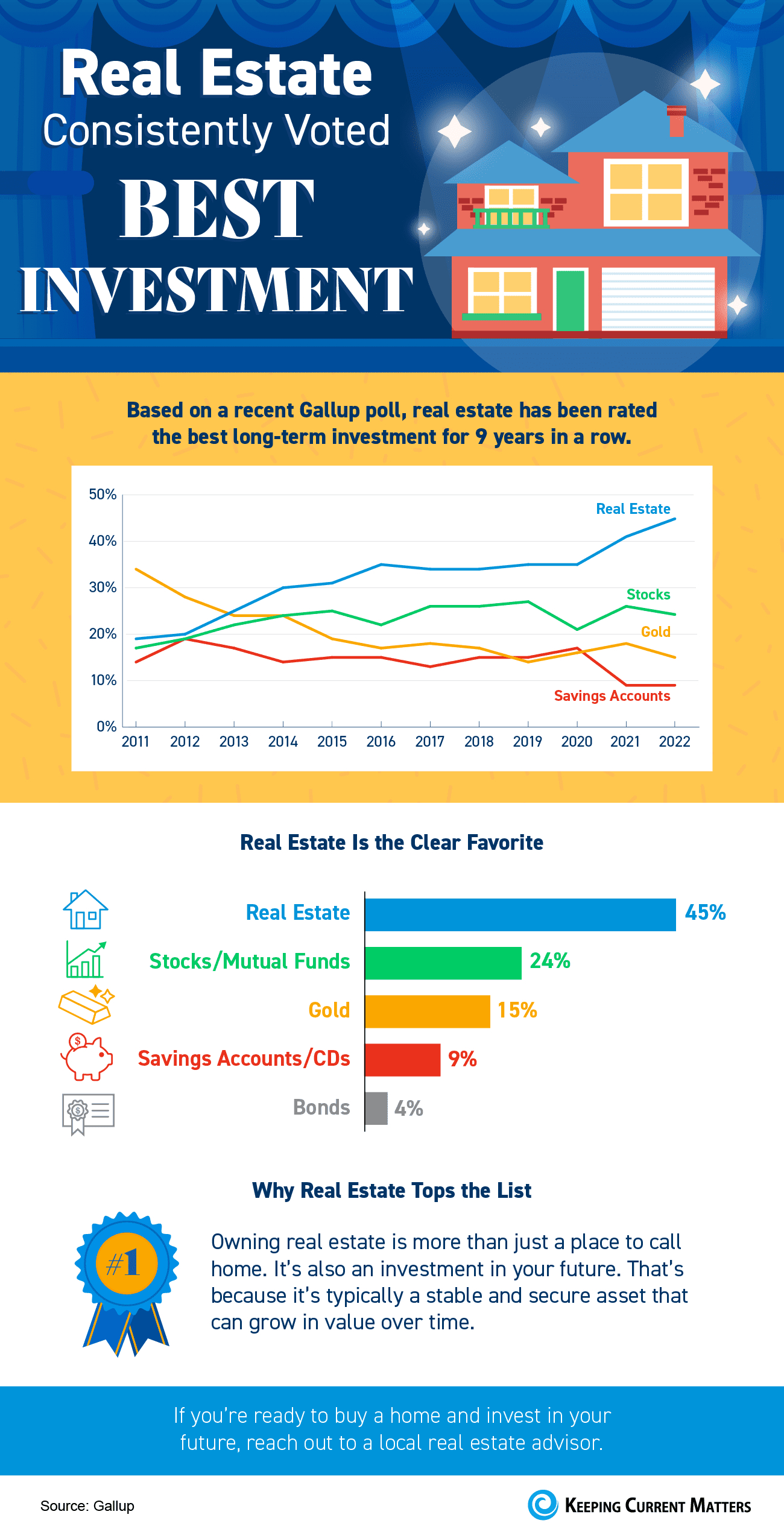

Real Estate Consistently Voted Best Investment [INFOGRAPHIC]

Some Highlights Based on a recent Gallup poll, real estate has been rated the best long-term investment for nine years in a row. Wow! Owning real estate is more than just a place to call home. It’s also an investment in your future. That’s because it’s typically a stable and secure asset that can grow […]

If You’re Selling Your House This Summer, Hiring a Pro Is Critical

It can be tempting, especially with how hot the housing market has been over the past two years, to consider selling your home on your own. But today’s market is at a turning point, making it more essential than ever to work with a real estate professional. Not only will a trusted real estate advisor […]

Homeownership Could Be in Reach with Down Payment Assistance Programs

A recent survey from Bankrate asks prospective buyers to identify the biggest obstacles in their homebuying journey. It found that 36% of those polled said saving for a down payment is one of their primary hurdles to buying a home. If you feel the same way, the good news is there are many down payment […]

A Key Opportunity for Homebuyers

There’s no denying the housing market has delivered a fair share of challenges to homebuyers over the past two years. Two of the biggest hurdles homebuyers faced during the pandemic were the limited number of homes for sale and the intensity and frequency of bidding wars. But those two things have reached a turning point. […]

Two Reasons Why Today’s Housing Market Isn’t a Bubble

You may be reading headlines and hearing talk about a potential housing bubble or a crash, but it’s important to understand that the data and expert opinions tell a different story. A recent survey from Pulsenomics asked over one hundred housing market experts and real estate economists if they believe the housing market is in […]