It seems like every media outlet, and perhaps every person on Earth, is debating if the housing market is going to crash soon. While the truth is that no one really knows what’s going to happen, we can examine data and attempt to determine what is most likely to happen.

Personally, I don’t believe a market crash (which I define as a price decline of 10% or more) is the most likely scenario as of now. I think the more likely outcome over the coming years is a significant moderation of the housing market, with a chance that prices flatten or even go modestly negative for a period in late 2022 or 2023.

That’s my interpretation of the data. But at the same time, I also recognize there is more risk in the market now than there has been since 2007. Because that risk exists, I think it’s important to examine what would have to happen to market fundamentals for the market to crash. This way, you all can determine what you believe is likely to happen for yourself.

When it comes to housing prices (or the price of anything in a free market), everything ultimately comes down to good old supply and demand. Of course, other variables like inventory, inflation, and interest rates, all matter – but they only matter insofar as they impact supply and demand.

Right now, there is much more demand than there is supply. This has been the dynamic for the last several years and is the reason prices have been skyrocketing.

If you’re thinking to yourself, “low-interest rates are why prices have risen,” that’s true! It’s a hugely important factor – because it has driven up demand. When interest rates fall, housing affordability increases, which increases demand. People can afford more, so more people choose to enter the housing market – otherwise known as increasing demand. It all comes down to supply and demand.

For a crash to happen, we need to see a significant shift from an environment where demand exceeds supply to where there is more supply than demand. The only way prices can decrease is when supply exceeds demand.

Will that happen? Let’s look at what’s going on with both supply and demand.

Demand

A few things have fueled the extremely high demand we’ve seen for the last few years.

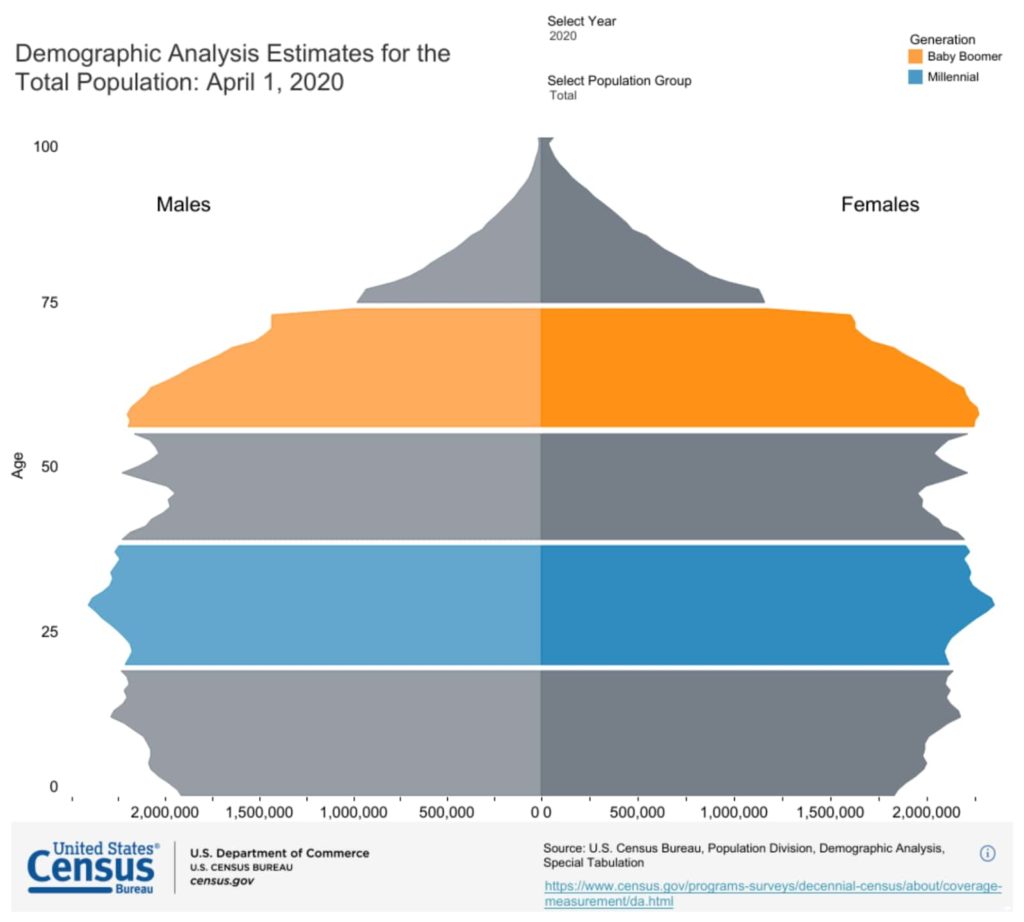

First and foremost, demand is driven by homebuyers. Specifically, homebuyer demand has been led primarily by millennials, which is the largest generation in the country, in peak family formation years.

Many people believe investors or iBuyers are leading demand, but that’s not true. Investors only purchase about 19% of homes. In contrast, millennial homebuyers account for 43% of all home purchases. They are the strongest and most consistent source of demand in the housing market.

That said, investor and second home activity are also up from pre-pandemic levels, which have supported the increased demand among primary homebuyers.

So will this high level of demand continue? In my opinion, no. There are already early signs that demand is starting to fall off, and I believe that will continue as long as interest rates continue to rise (which is probably for a few years).

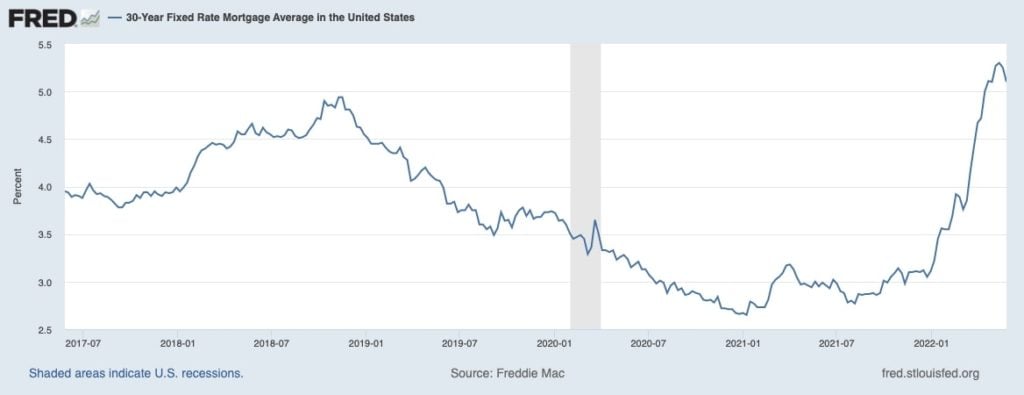

Interest rates have risen incredibly fast over the last few months.

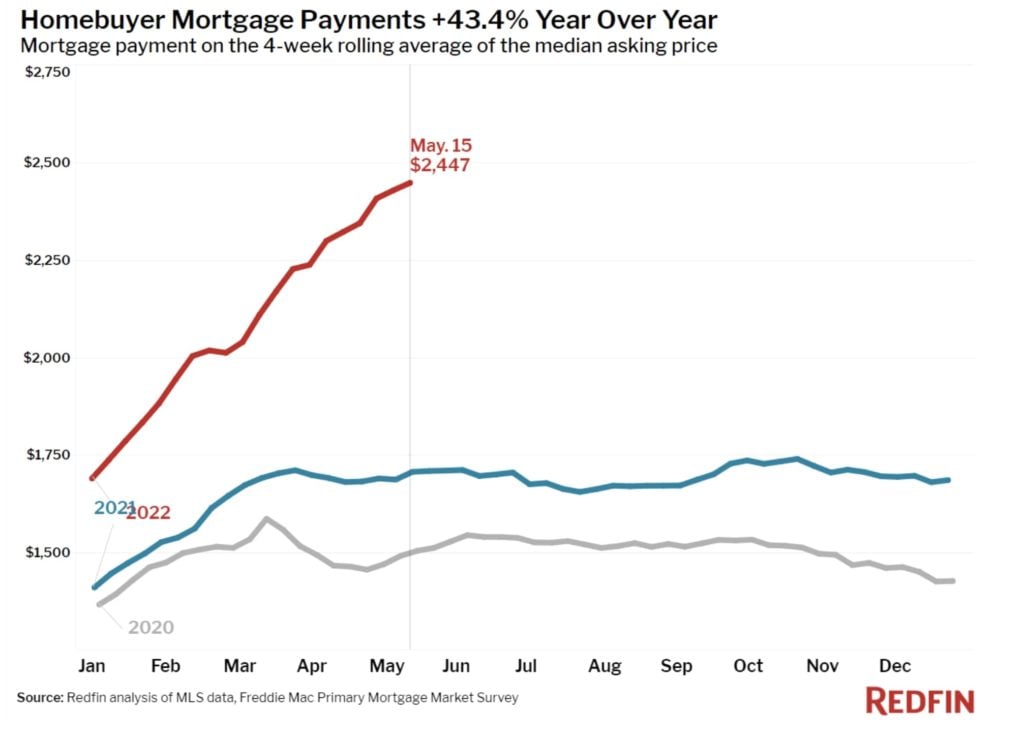

And although rates are still relatively low in the historical context, affordability is dropping rapidly. According to Redfin, Monthly mortgage costs were up over 43% year-over-year in March.

Declining affordability will have a real impact on the number of households entering the market. The National Association of REALTORS® (NAR) estimates that 15% of first-time homebuyers will be priced out of the market this year.

This is significant, but for the market to crash, which I define as a drop in prices by 10% or more, we would need this to translate from decreased affordability to a quantifiable decline in demand. One data point I track closely is the Mortgage Bankers Association’s (MBA) weekly survey, which measures how many people are applying for purchase applications. At the last reading, applications were down 16% year-over-year.

Although -16% YoY sounds like a lot, and it is for sure, it’s not been enough to slow down the market so far. Prices are still moving upward. Remember, demand was super high last year, so -16% from 2021 is still pretty decent demand, especially when considering how few properties are on the market for people to even buy.

That said, demand is starting to falter as prices and interest rates rise. It’s just not enough to make any dent in prices or inventory, at least with the data available in late May 2022.

As I said earlier, for the market to crash, we need demand to dry up considerably and rapidly, and that hasn’t happened. We just saw rates rise faster than any time I’ve ever seen, and demand didn’t evaporate. People are still buying. Yes, demand is down – but not in a way that, on its own, could cause the housing market to crash.

But demand doesn’t operate in a vacuum. You cannot just look at the demand side of the equation. You need to look at supply, which is the big story in 2022.

Supply (Inventory)

In my opinion, until inventory (which I use as a proxy for supply) recovers to more normal levels, there is no chance of a housing market crash. It’s just not possible.

Think about this logistically. How do prices in the housing market (or any market) decline? When sellers cannot sell their homes. Only when houses sit on the market for weeks or months will sellers consider lowering their prices. No seller is going to proactively lower prices. They need to be forced to lower the price.

It’s not as if sellers see rates rise and decide, “I’ll just lower the listing price of my home now because rates are up.” Or, “Wow, the MBA survey shows 11% fewer applications from last year. I think I’ll give up $50,000 and list my property for lower.”

That will never happen.

For housing prices to decline, properties must sit on the market for long periods of time. Only once sellers see their property sit for a few weeks will they consider lowering prices. If that happens for a couple of months, sellers might adjust their expectations for sales prices, but that will take some time.

So let’s look at where we are for inventory right now.

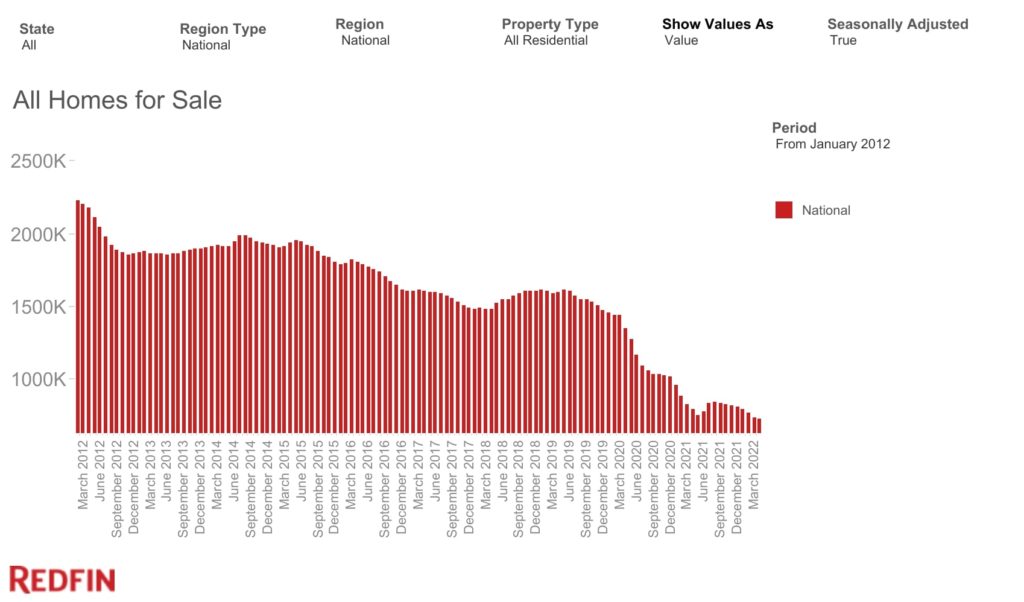

Look at the dramatic story this chart from Redfin tells. At the beginning of the housing market recovery following the Great Recession, we saw inventory (defined as the total number of active listings on the last day of a given period) at about 2M during the busy summer months. Pre-pandemic, we expected about 1.6-1.7M during the peak summer selling months.

Right now, inventory is sitting around 600k.

Think about that. In 2017-2019, prices were still going up when we had over 1.5M homes on the market. Now, we have 600k. Supply remains over 1M properties below where it was pre-pandemic.

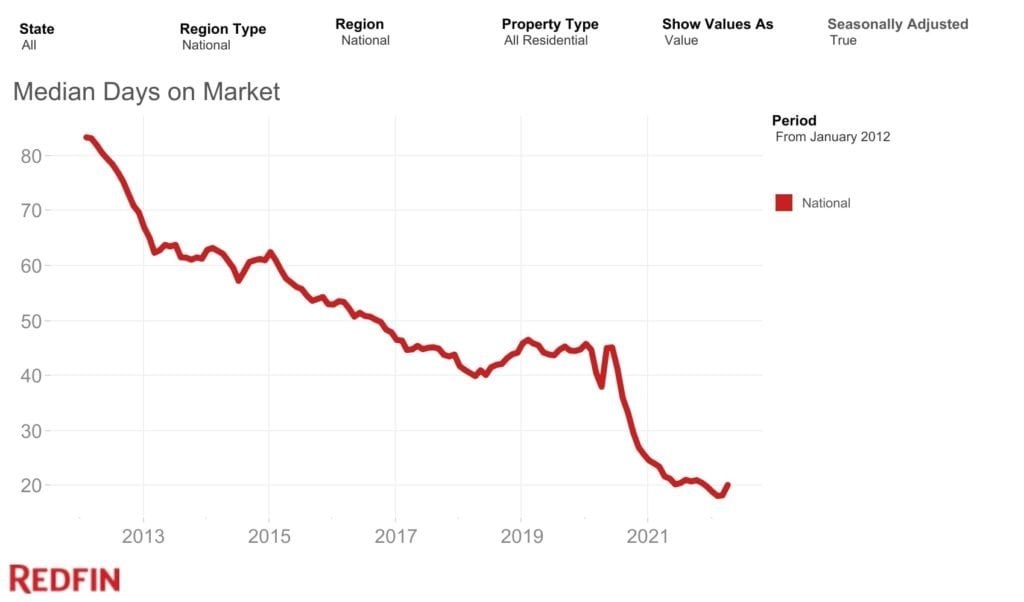

Days on market (DOM), an excellent measurement of the balance between supply and demand, tells the same story. Pre-pandemic DOM was about 45 days. Now? Even with higher rates, it’s still under 20.

I know people like to say the market will crash because prices have gone up so much, but that cannot happen with these market dynamics. Supply is extremely low, and for the market to crash or even moderate, inventory and DOM need to increase.

We have a long way to go – I’m not talking about a little more inventory. We need inventory to at least double – maybe even triple – over a few months for the market to crash.

Could that happen? Let’s look. Inventory could come from three places: New listings (more people putting their houses on the market), foreclosures, or new construction.

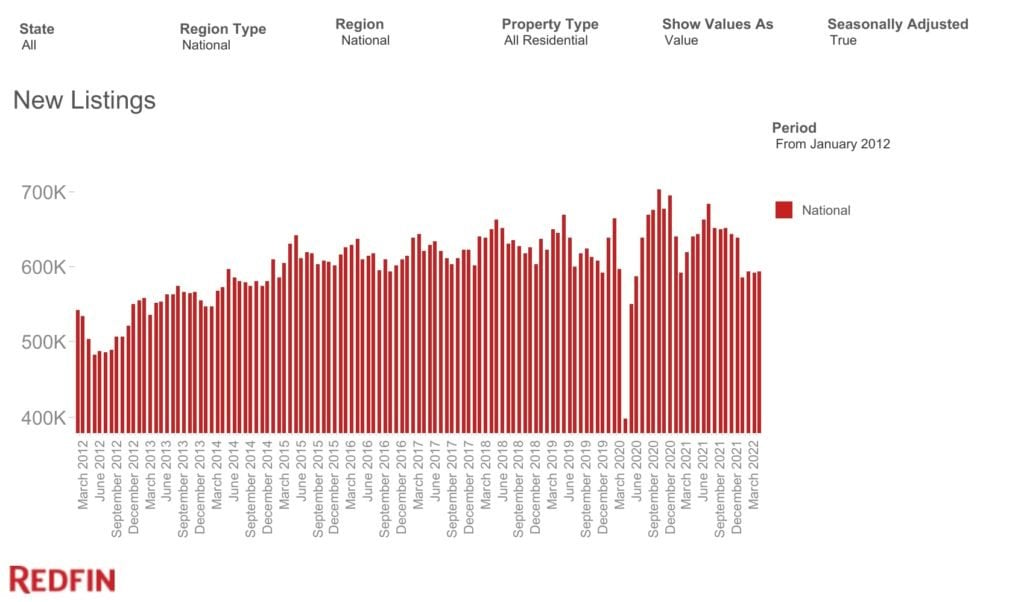

New listings are trending in the wrong direction, when you look at the data on a seasonally adjusted basis (which you should).

Why? People don’t want to sell into this market! An estimated 51% of homeowners now have a mortgage rate below 4%. Why would they sell into a super expensive market only to get a higher rate on a mortgage and face stiff competition for their next home? To me, it’s unlikely we’ll see a glut of supply hit the market due to new listing activity.

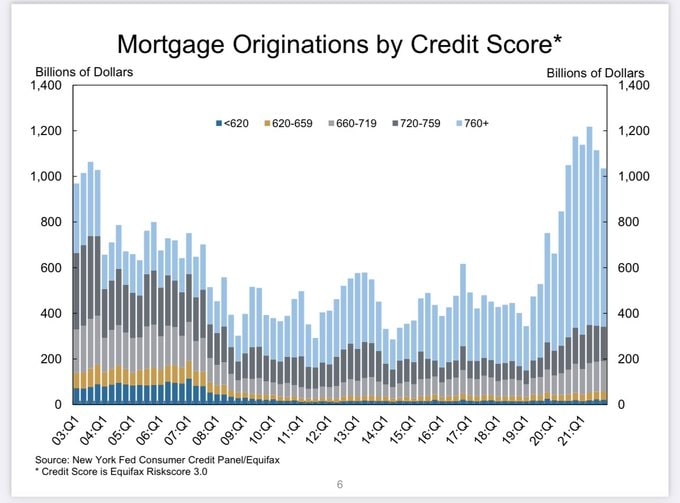

As for foreclosures, many people have been saying for two years that there will be a foreclosure crisis.

But that’s not going to happen. I know people keep saying it will, but it’s just not.

I’ve been saying this for over a year now. There will not be a foreclosure crisis due to COVID-19 and the forbearance program. It is simply not going to happen.

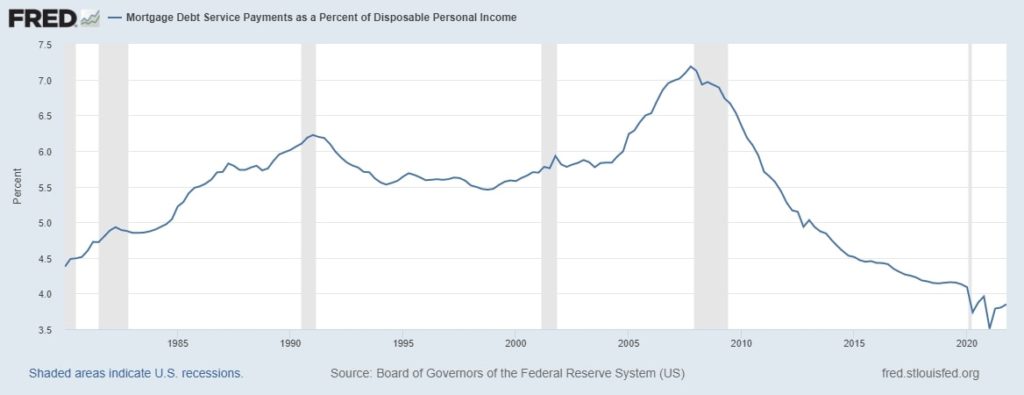

Mortgage delinquencies have dropped for seven straight quarters. The forbearance program worked. Almost no foreclosures are happening right now, and there aren’t many on the horizon. Even if millions of people went into default suddenly, it would take months or even years for that inventory to hit the market.

This isn’t 2008. People have equity in their homes, and the people who have debt are well positioned to service their debt. Roughly 90% of people who exited forbearance did so in good standing.

As for construction? Could that bring a glut of supply onto the market? I don’t think so.

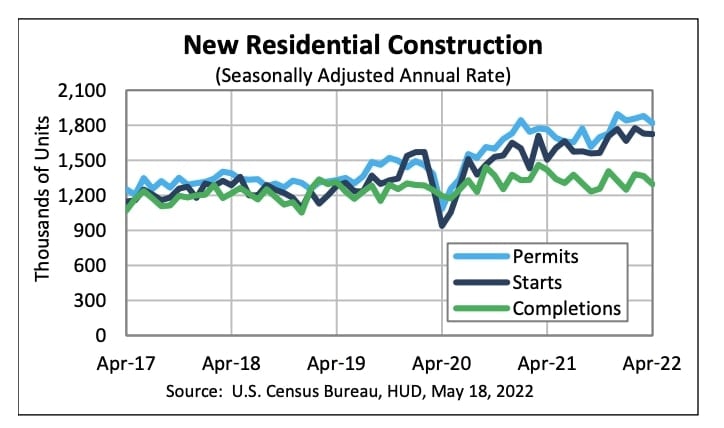

Construction permits and starts have increased but look at the green line above. Completions – houses that actually hit the market hasn’t increased. The labor market is super tight, and supply chain issues have prevented builders from completing homes.

I think completions will tick up soon, but remember we need inventory to increase by about 1,000,000 properties to get back to pre-pandemic levels, which means construction completions would need to increase about 80% over current levels. Not very likely. As of April, permits for new construction are already starting to dip, and I expect that decline to accelerate.

Could some modest increases in construction, new listings, and foreclosures combine to increase inventory in a meaningful way? Yes, that could happen, but it’s not the most likely scenario.

Conclusion

As the data reads today, I don’t see a crash as a likely outcome over the coming years.

To me, the only chance of a market crashing is that we have both a significant increase in supply and a substantial decrease in demand (demand is decreasing, but not enough to cause a crash).

Instead, I believe that demand will continue to decline, which will cool the housing market. Inventory could increase slightly, but I have a hard time seeing it going up too much.

All told, I think there is a reasonable chance prices will flatten in the coming years. Maybe even go down a bit as supply and demand rebalance, perhaps in 2023. But that’s just my interpretation of the data.

Overall, my confidence interval for housing prices is plus or minus 10% over the coming two years. Prices could keep going up, but not that much. Prices could go down, but not that much. I’m expecting much more moderate price changes compared to what we’ve seen over the last few years.

The data, right now, just doesn’t suggest huge movement one way or another. Keep in mind that my analysis is on a national level. I think some markets could see crash-level declines while others don’t decline at all. Real estate is local, but I am doing my best to summarize the housing market in one national-level number.

Of course, this is just a snapshot in time. I’ll keep an eye on the data every day and keep you posted as things evolve.

Original article found at https://www.biggerpockets.com/blog/is-the-housing-market-about-to-collapse