Last month, we paid off the $195,000 mortgage on our dream home.

After 4 years of focus and partnership with my wife Nicole, we’re now completely debt free and thrilled about the future ahead of us.

To help our two young children remember this family tree-changing moment in our lives, we decided to celebrate with them.

Instead of just burning the mortgage and tipping back a few glasses of champagne (which we did too), my wife came up with a completely original idea: “The Mortgage Pinata”.

The Mortgage Pinata

Yes! It’s just like it sounds.

We made a paper mache pinata out of our mortgage papers and our kids got to clobber the candy, toys and quarters right out of it!

The kids had a blast and so did we. This was a moment we wanted our kids to remember. It was the day we decided that our family was going to become debt free for life.

When it’s all packaged up into a cute pinata whacking story like that, paying off your mortgage sounds pretty simple and easy. Well, it was slightly more complicated than that.

To break it down, I’ve outlined the 10 steps we took to pay off our $195,000 mortgage in less than 4 years.

10 Steps to Paying Off Your Mortgage in 4 Years

We were intentional, determined and ready to do something incredible for our family.

1. Start With a “Why”

When I’m about to complete any difficult challenge, I always try to think about the “Why” before the “How”. “Why” do I want to do this? That way, I can always refer back to my “Why” throughout the difficult process to keep me motivated.

So for me, my “why” for paying off the mortgage was about reducing the stress that comes with having a big mortgage and only one source of income. I constantly felt pressure at work to not mess up because if I did, we could lose our house!

With two little kids at home, I went into “Papa Bear Protection Mode”. Given that I’m a personal finance nerd, this was the best way I could protect them.

That was my “Why”. If you’re considering something big like this, I’d recommend starting with a “Why” as well. (And then nurturing it every step of the way.)

2. 15-Year Fixed Rate Mortgage

We chose a 15-year mortgage when we bought our new home. This made our monthly payments higher overall (versus a 30-year mortgage), but more of the payment was going to the principal each month.

By choosing a 15-year, we were also forcing ourselves to make larger principal payments. With a 30-year mortgage, we could decide to pay more or pay less principal depending on the month. We didn’t want that option. We wanted it to be gone fast!

Last but not least, our mortgage interest rate was only 3% with the 15-year mortgage versus a quoted 4% on a 30-year mortgage.

We chose to pay less to the bank and keep more for ourselves. If we went full term, we would have paid $92,752 more in interest to the bank! No thank you, Mr. Banker.

Jackie’s note: If you’re curious about how quickly you could pay off your house or other debts, check out the Pay Off Debt app. It might be quicker than you think.

3. Mortgage Payment No More Than 25% of Take Home Pay

With my first bachelor pad in 2004, I had a mortgage that was about 60% of my take home pay. Let’s just say I didn’t have a lot of money for important things like … oh ya know, food!

My first house folly in my 20’s is a hyperbolic example for more financially educated folks, but it stuck with me when we were looking for our next house. We wanted to be in our dream house for the next 30 years so our payment (principal, interest, taxes and insurance) needed be comfortable.

We made sure that our monthly mortgage payments did not exceed 25% of our take home pay. This allowed us to allocate the other 75% to other areas of our life like household expenses, food, transportation, entertainment, saving and investing.

In this example, if you take home $4,000 per month (after taxes), your mortgage payment shouldn’t be more than $1,000. Obviously, do what’s best for you and your family, but this is what worked for us.

4. Commit and Set a Date

My wife Nicole and I came to agreement that we’d dial back our lifestyle and pay this mortgage off in less than 5 years.

This would require sacrifice on our part, but honestly we live in the most privileged country in the world. How much “sacrifice” are we really talking about here?

5. Live on 50% of Your Income

In 2011, we paid off $48,032 of consumer debt. Since that time, we’ve consistently lived on about 50% of our income. There have been years when we’ve spent more and years where we’ve saved more. On average, we’ve been a couple who saves around half and spends around half.

In order to pay off the mortgage in less than 5 years, we knew we needed to continue this 50/50 path. We had prepared ourselves for this reality and it wasn’t bad when we were both employed. When Nicole and I decided that she’d leave her job and stay at home with our two kids in 2014, the story changed a bit.

Here are 5 things we did to trim our expenses further:

- Decrease our grocery spending by ⅓ (Aldi rocks!)

- Cut the cord on cable (think HD Antenna

)

- Embrace all the free and inexpensive things to do with kids (library time)

- Negotiate our cable and cell phone bills (can I speak to customer retention please?)

- Take advantage of higher deductible insurance plans (you’ll need an emergency fund; here’s how to build one)

6. Increase Your Income

Even with all of our cord cutting and grocery trimming, it was getting a little tight for us to live on one income and still pay this mortgage off in less than 5 years. And after all, you can only cut back so much. With income on the other hand … the sky’s the limit!

We did the the following things to increase our income over the past few years:

Sell Stuff Around the House

Clothes, electronics, unused gift cards, purses, bikes and even my prize moped was sold (it was time … I hadn’t driven it in a year).

It’s truly amazing how much STUFF we accumulated in our house that we didn’t need or didn’t bring us joy. Turn the trash into cash, right?

Kick A** at Work

I’m in sales. If I crush my goals, then I can be rewarded with a bonus. I went into overdrive for the last couple of years and it paid.

Start a Blog

In 2016, I started a blog and podcast that chronicled our families path to mortgage debt freedom. I’ve been able to help people on a similar journey and make some money while doing it..

7. Budget Monthly With Your Spouse

Lucky number 7 here is probably the most important success in my eyes. The collaboration that my wife and I had over the past 4 years has been incredible. I’m so proud to be married to Nicole. She’s a true partner.

Okay, enough lovey dovey … Get to the details, Andy!

On the first day of every month since 2012, Nicole and I have used Mint to plan out our household budget. We review our spending from the previous month, allocate our dollars for the current month and review our goals for the future.

We dub this meeting our “Budget Party”. Well, I called it that originally to get Nicole excited about joining me. I added in pizza, beer and wine to the “party” but she saw right through me and my marketing tactics.

She eventually joined the “party” after some gentle nudging. Today, she’s the one keeping me on task!

The budget we create together is a “zero-based budget”. (Get a free budget template here.) This means that every dollar we have has a job. For example, if we have a $4,000 monthly income, all 4,000 of those dollars will be allocated to spending, saving, investing, etc. If we didn’t tell those dollars where to go, they’d magically float away. You know what I’m talking about, right?

If you’re more into spreadsheets than a system like Mint, I’d recommend Tiller. Nicole and I are trying it out lately and really enjoying the flexibility.

8. Remember to Have Fun … But Be Careful

With our tighter mortgage crushing budget, we didn’t have a lot allocated for fun … especially vacations. We decided that we’d take advantage of travel rewards for some free or inexpensive travel. Between my work travels and our responsible credit card usage, we were banking some solid travel rewards.

In 2016, we traveled to New York for a romantic getaway weekend on travel rewards. Flights and hotel would have cost us $1,500. We paid $0.

In 2017, we traveled to Ft. Lauderdale for our anniversary. Yep, travel rewards paid for that one as well.

Next year, we’re planning on taking our family of four to Disneyland for a whooping $220.

I’m not saying that using credit cards is for everyone. CREDIT CARDS CAN BE DANGEROUS AND CAN RUIN YOU FINANCIALLY. NerdWallet reports that the average US household that carries credit card debt has a balance of $15,654.

For those who can live on a consistent monthly budget and are extremely responsible with their money, they might as well enjoy the perks that come from credit cards. If you consistently carry a credit card balance and have trouble making your payments, I’d highly recommend paying with cash or a debit card. (Jackie’s note: Definitely do not use credit cards for rewards if you’re in that situation.)

9. Celebrate the Wins

Four years is a long time to wait for a big goal. We decided to celebrate along the way.

When we went below $100,000 in our mortgage balance, Nicole and I went out to a nice dinner to celebrate. We ate at our favorite restaurant and enjoyed some champagne to commemorate this milestone in on our journey.

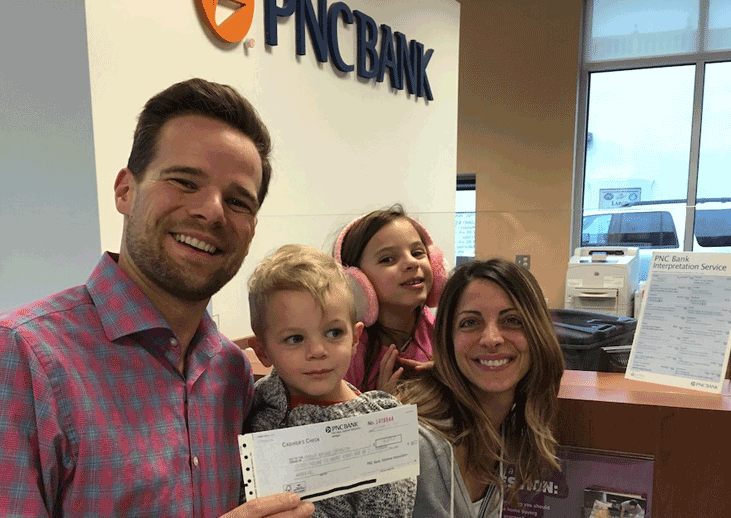

And on the big mortgage pay off day, our family of four went to the bank together. We took a picture as a family and went to a local diner to celebrate. My 3-year old had an epic meltdown in the restaurant because his jacket wouldn’t zip, but hey, not everything can have a storybook ending!

10. Dream About the Future

Now that the mortgage is gone, we’re setting our sights on the future. We’ll have around $35,000 extra each year to allocate.

- Can our kids go to college and not go into debt?

- Should we start a family business?

- Can we go on guilt-free vacations each year?

We don’t have all of the answers quite yet, but we’re really enjoying planning out our next steps. For now, we’re saving up our money so we can make the best decisions for our family’s future.

What I do know is that my stress level at work has decreased significantly. I can confidently say, “No one will ever take away our house.” To be able to say that has definitely made the “Papa Bear” in me quite proud.

Original article found at: https://www.jackiebeck.com/paid-off-our-195000-mortgage-in-4-years/