Mortgage Interest Rates Today

What are today’s mortgage rates?

The average 30-year fixed mortgage rate fell 1 basis point to 2.95% from a week ago.

The 15-year fixed mortgage rate fell 1 basis point to 2.37% from a week ago.

Additional mortgage rates can be found in the chart and graph below.

| 3-month trend | 30-Year Fixed Rates | 15-Year Fixed Rates | 5/1 ARM Rates | 30-Year Jumbo Rates |

|---|---|---|---|---|

| 1/6/2021 | 2.950% | 2.370% | 2.870% | 3.410% |

| 12/30/2020 | 2.960% | 2.380% | 2.890% | 3.410% |

| 12/23/2020 | 2.950% | 2.370% | 2.880% | 3.400% |

| 12/16/2020 | 2.960% | 2.400% | 2.890% | 3.420% |

| 12/9/2020 | 2.990% | 2.390% | 2.930% | 3.400% |

| 12/2/2020 | 3.000% | 2.420% | 3.020% | 3.440% |

| 11/25/2020 | 3.010% | 2.440% | 3.010% | 3.440% |

| 11/18/2020 | 3.030% | 2.450% | 3.050% | 3.460% |

| 11/11/2020 | 3.120% | 2.500% | 3.080% | 3.480% |

| 11/4/2020 | 3.040% | 2.470% | 3.010% | 3.480% |

| 10/28/2020 | 3.030% | 2.460% | 3.010% | 3.490% |

| 10/21/2020 | 3.060% | 2.470% | 3.090% | 3.490% |

| 10/14/2020 | 3.050% | 2.470% | 3.090% | 3.500% |

| 10/7/2020 | 3.080% | 2.530% | 3.070% | 3.480% |

| 9/30/2020 | 3.050% | 2.490% | 3.170% | 3.500% |

| 9/23/2020 | 3.100% | 2.530% | 3.200% | 3.520% |

| 9/16/2020 | 3.090% | 2.530% | 3.210% | 3.550% |

What is a mortgage interest rate?

Lenders charge interest on a mortgage as a cost of lending you money. Your mortgage interest rate determines the amount of interest you pay, along with the principal, or loan balance, for the term of your mortgage.

Mortgage interest rates determine your monthly payments over the life of the loan. Even a slight difference in rates can drive your monthly payments up or down, and you could pay thousands of dollars more or less in interest over the loan’s term. Knowing how interest rates factor into your loan pricing, as well as what goes into determining your rate, will help you evaluate lender estimates with more precision.

What factors determine my mortgage rate?

Lenders consider several items when pricing your interest rate:

- Credit score

- Down payment

- Property location

- Loan amount/closing costs

- Loan type

- Loan term

- Interest rate type

For starters, your credit score impacts your mortgage rate because it’s a measure of how likely you are to repay the loan on time. The higher your score, the less risk you pose so you’ll receive lower rates.

Lenders also look at your down payment amount. For example, if you bring a 20 percent down payment to the table, you’re seen as a less risky borrower and you’ll nab a lower rate than someone who’s financing most of their home purchase, which puts more of a lender’s money on the line if you were to default. (That’s also why lenders require you to pay private mortgage insurance with less than 20 percent down.)

The loan amount and closing costs also play a role in your mortgage rate. If you ask a lender to roll your closing costs and other borrowing fees into your loan, for example, you’ll typically pay a higher interest rate than someone who pays those fees upfront. Borrowers may also pay higher rates for loans that are above or below the limits for conforming mortgages, depending on the lender’s guidelines.

Rates also depend on the type of mortgage you choose, the loan term and the interest type. You’ll pay much lower interest rates for shorter-term loans than longer-term loans because you’re paying off the mortgage faster. Adjustable-rate mortgages come with lower initial rates than their fixed-rate counterparts, but when the loan resets, rates can fluctuate with the market for the remainder of the loan term.

Use a mortgage calculator to plug in interest rates, your down payment, loan amount and loan term to get an idea of your monthly mortgage payments and other loan details.

What is the best credit score to get a mortgage?

An excellent credit score of 760 or higher generally will help you qualify for the most competitive rates offered by the mortgage lender. However, you don’t need excellent credit to qualify for a mortgage. Loans insured by the Federal Housing Administration, or FHA, have a minimum credit score requirement of 580.

Ideally, you want to work on your credit (if you have a lower score) to get the best loan offers possible. While you can get a mortgage with poor or bad credit, your interest rate and terms may not be as favorable.

What is the APR on a mortgage?

The APR, or annual percentage rate, on a mortgage reflects the interest rate as well as other borrowing costs, such as broker fees, discount points, private mortgage insurance, and some closing costs. The APR is expressed as a percentage and is usually a better indicator of your true borrowing costs than current mortgage rates alone.

How do I get the best mortgage rate?

To get the best mortgage rate, shop around with multiple lenders. Ideally, you want a rate that’s at least equal to, or better yet below, the current average rate for the loan product you’re interested in. Comparing rates from three, four or more lenders helps ensure you’re getting competitive offers on a new mortgage or a refinance. Inquire with large banks, credit unions, online lenders, regional banks, direct lenders and a mortgage broker to shop for a mortgage.

If lenders know they have to compete for your business, they might be more inclined to scrap certain fees or provide better terms. Additionally, you want to be comfortable with the mortgage process, and working with a reputable lender who is attentive and service-oriented will make the process go more smoothly.

You also want to compare loan fees, terms and offerings. Keep in mind that current mortgage rates change daily, even hourly. Rates move with market conditions and can vary by loan type and term. To ensure you’re getting accurate current mortgage rates, make sure you’re comparing similar loan estimates based on the precise term and product.

Original article found at https://www.bankrate.com/mortgages/current-interest-rates/

Mortgage Rates Fall To 50-Year Low

A “sold” sign is posted on a home in Westfield, Ind., Friday, Sept. 25, 2020. The housing market has staged a furious comeback this summer, even as the economy struggles to regain its footing. Home sales have surged to the highest level in more than a decade. The strength has been driven by ultra-low mortgage rates, fierce competition for a dearth of properties on the market and a wave of millennials and others vying to become homeowners. (AP Photo/Michael Conroy)

ASSOCIATED PRESS

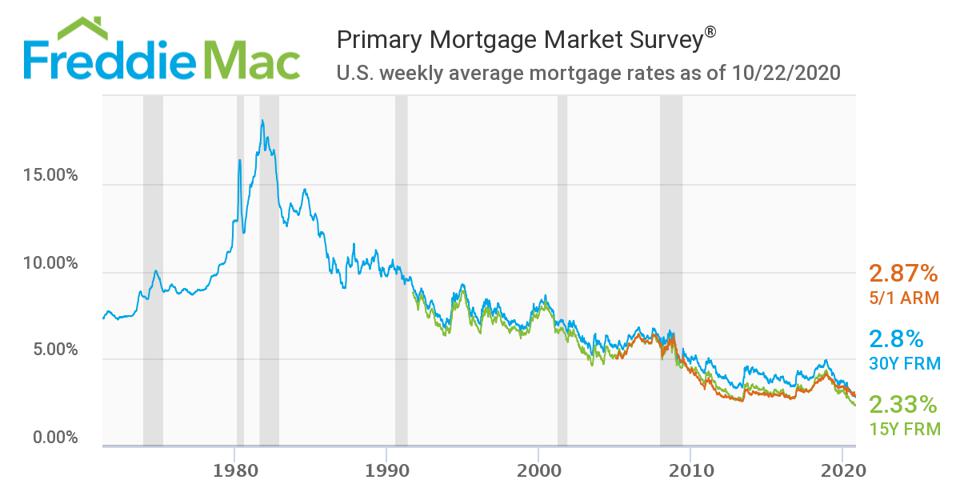

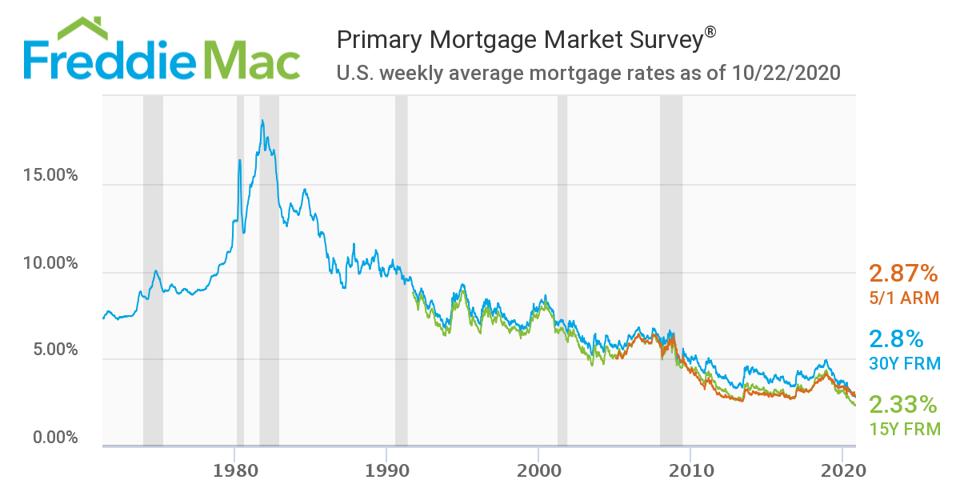

Mortgage rates have never been lower. That’s the upshot from Freddie Mac’s weekly Primary Mortgage Market Survey. As of October 22, 2020, Freddie Mac reported that rates on a 30-year fixed-rate mortgage (FRM) had dropped to 2.8%. The rate on a 15-year mortgage declined to 2.33%. Both had additional fees and mortgage points totaling 0.6% of the mortgage amount.

A 5/1 adjustable-rate mortgage (ARM) often has an initial interest rate that’s lower than a fixed-rate mortgage. Freddie Mac, however, reported that a 5/1 ARM had a higher rate of 2.87%. Its fees and mortgage points were a bit lower at 0.3%.

Freddie Mac

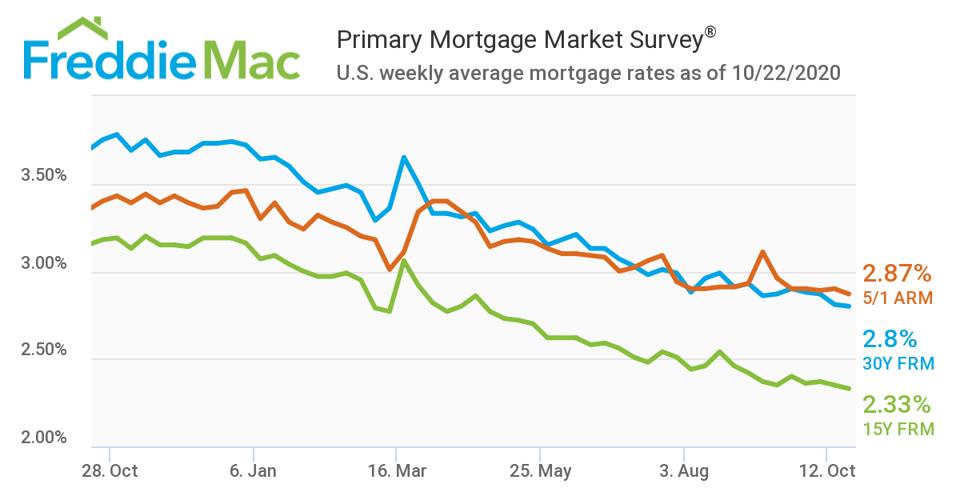

As the chart above reflects, mortgage rates have come down significantly over the past year. A 30-year fixed-rate mortgage a year ago charged interest of about 3.7%, nearly 1.5% higher than today’s rates. On a $300,000 mortgage, today’s lower rate translates into a savings of about $225 a month, before factoring in taxes.

Mortgage Rates at Historic Lows

Freddie Mac’s PMMS dates back to April 1971. For those history buffs among you, the rate on a 30-year fixed-rate mortgage on April 2, 1971, was 7.33%. It hit its high-water mark on the week of October 9, 1981, at an unthinkable 18.63%. To put that number into perspective. the principal and interest on a $300,000 30-year mortgage at today’s rate would cost $1,159 a month. At the rates prevailing in October 1981, the monthly payment on the same home loan would skyrocket to $4,676.

A chart from Freddie Mac shows the downward trend in rates over the past four decades.

Freddie Mac

Note that Freddie Mac didn’t track 15-year mortgages until 1991 and the 5/1 hybrid ARM until 2005.

Low Rates Drive Housing Costs Higher

One of many things I’ve learned from Warren Buffett is that low interest rates drive asset prices higher. That’s certainly true in the housing market. As reported by Forbes Advisor, single-family home prices rose in 174 of 181 metropolitan areas over the past year. Some areas have seen double-digit gains. Huntsville, Alabama, for example, saw a 13.5% rising in single-family homes.

More recently, the National Association of Realtors reported this month that existing home sales grew for the fourth consecutive month. As of September, sales grew at a seasonally-adjusted annual rate of 6.54 million, up 9.4% from the prior month and almost 21% from one year ago. At the same time, the median existing-home price was $311,800, up almost 15% from a year ago.

Low rates aren’t the only driver behind the rise of housing costs. As NAR reported, total housing inventory decline month-over-month and year-over-year to 1.47 million. NAR said it was a record low that at current prices is enough to last just 2.7 months. Mark Zandi of Moody’s Analytics also noted the move away from urban centers to single-family homes in the suburbs as a factor in driving up housing costs. Both a shift to work-from-home arrangements and a desire to move out of densely populated areas have driven this change.

Refinancing Accelerates

The low rates have also caused an uptick in refinancing. According to the Washington Post, a key metric showing home owners paying off mortgages early rose to its highest level in 16 years. Prepayment activity reached more than 3% of all mortgages, up 12.7% from the prior month, according to mortgage data analytics firm Black Knight.

The low rates can make refinancing enticing even for those who purchased or refinanced a home just one year ago. As noted above, today’s lower rates could save a borrower over $200 a month on a $300,000 30-year fixed rate mortgage. According to the Mortgage Bankers Association, mortgage applications volume decreased 0.6% on a seasonally adjusted basis from the prior week. This could be due in part to higher housing costs. Yet the Refinance Index shows an increase of 0.2% from the previous week and was 74% higher than a year ago.

Covid-19 Can’t Slow the Housing Boom

The housing market is one of the few economic bright spots during the Covid-19 inspired recession. The increase in housing costs raises the question of whether we are in another housing bubble reminiscent of the 2007 crisis. Those in the real estate business naturally dismiss the idea of a housing bubble. While they acknowledge that some markets are overvalued, they believe this is driven by high demand and low supply. The numbers do support this theory.

At the same time, one can’t help but recall these words: “Those who cannot remember the past are condemned to repeat it.”